Woohoo! Looking back at 2019, what a year it was! The year my wife and I got on the same page about money, got on the same page about our health, took our heads out of the sand, and executed a plan with amazing results.

We didn’t start 2019 with the expectation of paying off all our consumer debt or changing our health around. There were no “new year resolutions” of “losing 10 pounds” or “paying off the car”. No, those “resolutions” never worked for us, the drive and determination would always quickly fade by the end of January.

We were already “aggressively” paying off our debt, but the timeline of being “debt free” was still 5 years out, we were looking at the year 2023! The debt burden was taking a negative toll on our health, almost suffocating us if you will. We thought we were doing it right too, save a little money here, invest a little money there, pay off more than the minimum on the monthly debt payments. The slowwww grind, because that’s just the way it had to be. At the time, we had over $60,000 in student loans, and around $30,000 in auto loans remaining.

My wife and I were not yet on the same page about money either, there was no budget to refer to, no automated financial systems in place. No hard number of our total debt. One was a spender and the other a saver. So what happened?

A random Dave Ramsey YouTube video changed it all in late January 2019. This single video was the spark that made us have a serious discussion about our finances. This video literally changed our lives and our financial futures forever. You would think if that video had such an impact on us, I would remember it. I don’t! Ha! (We’ve watched hundreds since then). I think the message we took from it was that we weren’t alone, there were hundreds, thousands, even millions of people just like us trying to dig their ways out of debt. The “baby steps” that Dave recommends gave us a blue print to follow. Did we follow it to a “t”? No, but it was a jumping off point.

The discussion we had that night was hard for both of us. I grew up in a single parent household were money was a not always plentiful, so as an adult I viewed having money in the bank as a “comfort blanket” against struggle, against job loss, against being vulnerable. So when it came to executing Dave Ramsey’s baby step of having only “$1000” in an emergency fund and throwing everything we had at the debt it terrified me. $1000? Ha! A car repair or an issue with the house or god forbid a health issue could easily wipe out a $1000 in a blink of an eye. It felt like standing on a diving board above a pool and being afraid of heights.

We took the plunge. We took our savings, liquidated our taxable investment account, tax refund, bonuses, and as much of our paychecks as we could while still being able to “keep the lights on” and “being able to eat” and threw it at our debt with vigor.

Throughout 2019, we posted entries that highlighted bits and pieces of our plan, and the thoughts behind it…

Getting on the same page with your significant other is the bedrock of our success. If one is a saver and the other is a spender, neither having limits, you won’t succeed. Most folks see talking about money as a taboo but you need, need, NEED to have that tough conversation in order to succeed.

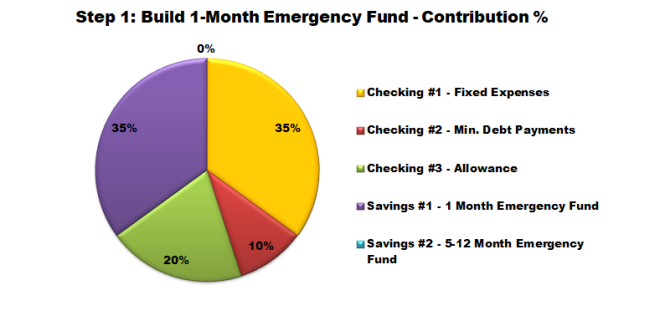

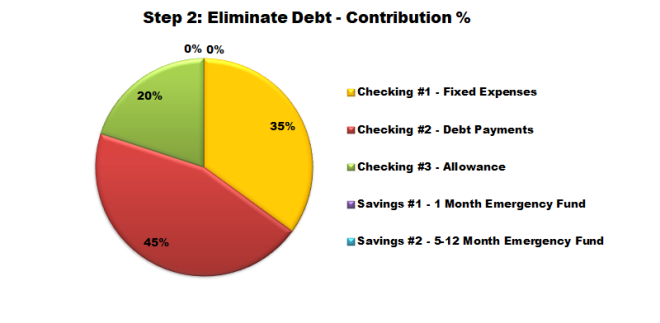

We developed the 35/45/20 rule that gave a framework that was different than the average run of the mill 50/20/30 rule that you hear so much of. After ridding ourselves of our consumer debt, we quickly went at increasing our emergency fund. Which came in handy when an unexpected medical event and auto repair took place in late 2019.

Paying off debt instead of investing outside of our retirement accounts was a massive moment for us. We didn’t follow Dave Ramsey’s advise here by stopping contributions to our retirement accounts, we thought the negative implications such as increasing our income tax liabilities and the mental effort of re-starting contributions again was too much of a risk. We actually went in the complete opposite direction, MAXING out our retirement accounts! This allowed us to also enjoy the stock market rise of 2019.

We developed a fancy excel sheet that tracked our net-worth and monthly expenses which became an exciting moment every month were we came together to see our progress. We made some free printables this year for others to start on their journey as well.

One of the many positive side effects of ridding our debt was the ability to focus on our health. Instead of going out to eat a few times a week, we decided to consistently cook at home, making large and healthy batches of chicken, vegetables, with rice or pasta. We were able to find a local instructor lead fitness center that we were more readily able to afford, and over the course of the year we were able to lose 70 lbs combined! Improving our blood pressure, increased our tolerance to stress, and shrunk our waistlines!

We are excited for 2020, we plan to continue to follow the 35/45/20 rule, and focusing on our health. Here’s to the new year!

Remember, we are not financial advisers and are merely sharing our experiences.

So what are your thoughts? We would love to hear from you! Leave a comment below or send us an email via our Contact Page.

If you liked what you’ve read please be sure hit the “like” button and share! If you want to receive the latest articles please be sure to subscribe.

How you go about this is up to you. What worked for us was “The Debt Snowball” method outlined by

How you go about this is up to you. What worked for us was “The Debt Snowball” method outlined by